Le contenu de cette page relève de la communication marketing

Race for the White House: What does the US election mean for SKAGEN?

The violent reaction to Brexit highlighted equity markets' aversion to uncertainty. Although post-Brexit losses have now been recovered, investors are understandably nervous as another close two-horse race enters its final furlong.

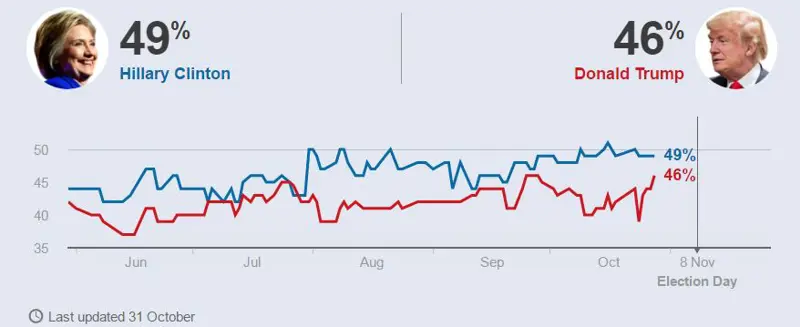

As we approach US election day, the latest opinion polls have Hillary Clinton ahead with 49% of the vote versus 46% for Donald Trump. Given this relatively slender lead and the pollsters' failure to predict both the UK referendum and general election outcomes, we examine the key policies of the two candidates and how these may impact our portfolio holdings.

SKAGEN's equity funds invest bottom-up with political risk factors analysed at the company level rather than top-down at the portfolio level. As Knut Gezelius, Lead Portfolio Manager of global equity fund SKAGEN Global, explains: "We believe our strength is stock selection, rather than trying to gain an advantage from an economic or political event. However, we closely monitor aggregate exposure and maintain sensible geographic and sector limits to make sure the portfolio isn't overly exposed to the risks of a particular outcome."

SKAGEN Global has the largest exposure to US-listed stocks across our equity funds at around 40% of the portfolio (see table below). This has remained broadly unchanged throughout the year although it has increased slightly in the third quarter, largely as a result of strong performance from the fund's two largest holdings, AIG and Citi. Emerging markets fund SKAGEN Kon-Tiki has only 6% of the fund invested across five US-listed companies, all of which operate globally with significant emerging market exposure (e.g. Cosan and CNH Industrial).

Underlying exposure more important

This highlights an important distinction between listing domicile and fundamental exposure, as Filip Weintraub, Lead Portfolio Manager of SKAGEN Focus, which has just over 30% of its portfolio invested in US-listed companies, explains: "Where a company is listed can be instructive for assessing risk and investor sentiment. It is more important, however, to look at the exposure of company sales, profits and assets to the US when determining how our holdings' fortunes may change under the different administrations."

Trade policy, for example, will have a direct company impact and although Clinton has been inconsistent, she is likely to be more expansive than Trump, who blames higher imports for US unemployment. Mexico, China and South Korea are all cited in his seven point plan to 'rebuild the American economy' and potentially face the threat of trade sanctions. At greatest risk are companies which export into the US and compete against firms which produce goods or services on US soil. In this respect, the threat to our portfolios looks limited.

Global, Kon-Tiki and Focus have no exposure to Mexican-listed companies while their exposure to Chinese-listed companies is relatively limited at 2.8%, 5.4% and 4.3%, respectively. For our largest Korean holdings, we also expect any impact to be relatively small. Knut Harald Nilsson, Lead Portfolio Manager of SKAGEN Kon-Tiki, explains: "For Hyundai Motor, around 70% of the cars it sells in the US are built there. We estimate that less than 10% of revenues would be exposed to any change in import duties, with an even smaller proportion of its profits likely affected given the highly competitive US car market. Meanwhile for Samsung Electronics, where we estimate 25% of sales are from the US, neither its handset nor semi-conductor businesses should be at a disadvantage to competitors which use similar production arrangements."

Building bridges

One of the few areas on which both candidates agree is the need to increase infrastructure spending. Clinton has outlined a five-year plan to spend USD 275 billion on ports, railways, pipelines and clean-energy projects while Trump's ambitions are much greater, targeting USD 1 trillion in investment on new roads, bridges and broadband. Company beneficiaries could include internet-provider Comcast and Taiheiyo Cement, a new holding in SKAGEN Focus, especially if Donald Trump wins and builds his Mexican border wall given the Japanese company's strong presence in California and Arizona.

Such expansive spending policies will inevitably have implications for taxation, which has been a major campaign issue and area of disagreement, as Gezelius explains: "Clinton's policies would generally increase the tax burden on larger businesses while Trump proposes to cut the headline corporate tax rate from 39% to 15%. This is a move that would benefit our US holdings with significant domestic operations and profits, such as AIG, Citigroup, Merck and General Electric."

If Trump wins and his combination of huge government spending and tax cuts materialises, the Federal Reserve would be more likely to raise interest rates to prevent the US economy from overheating. This scenario would help banks' net interest margins, potentially boosting Citigroup, Goldman Sachs, Citizens Financial, Synchrony Financial and CIT Group as well as the insurer, AIG, which would gain from higher bond yields.

Regulatory reform

Regulation under Trump is likely to be more business-friendly than it would be under Clinton with the former's pledge to remove up to 70% of federal rules. As Weintraub explains: "The banking sector in particular would benefit as he is likely to scale back the most 'anti-business' parts of the Dodd-Frank Act which was passed in the wake of the financial crisis. A Trump victory could also boost the energy sector where the removal of restrictions to increase oil exploration and production could help companies like Whiting Petroleum." Cash-rich technology companies could also benefit if more relaxed regulation increases M&A activity, potentially lifting companies like Microsoft and Alphabet.

Healthcare is a sector that could see significant change with the future of the Affordable Healthcare Act at the centre of both candidates' plans for reform. While Trump is promising to replace 'Obamacare' with something cheaper, Clinton is looking to build on it and create a national healthcare system, an initiative which could boost AIG if accompanied by greater demand for health insurance. A Clinton victory would likely put pricing pressure on the pharmaceutical industry and therefore drug company holdings like Merck, Israeli Teva and Swiss-based Roche could benefit from a Trump victory.

Mispricing opportunities

As with any predictions, it is important to sound a note of caution: forecasting the winners and losers under a new administration is not only difficult but may ultimately be futile. For example, gun-making and healthcare stocks have flourished under Obama while clean-energy companies are down 50%, contrary to what might have been expected when he took office.

A safer prediction is that markets will stay volatile for as long as the race for the White House remains close. As Gezelius outlines: "At the moment it's too close to call but from the financial markets' perspective a Clinton victory would be the safer option while Trump is clearly a wild card. The uncertainty created if he wins would boost volatility and given how markets tend to overreact, create mispricing opportunities for stock-pickers akin to the ones we were able to take advantage of post-Brexit."

Longer term it is unlikely that either outcome will leave a significant imprint on the world's largest stock market, as Weintraub explains: "History shows that changing presidents has little effect on US equities. In reality, it is the Congress rather than the President that decides legislation and whoever wins will need to water down their more radical plans if they are to have any chance of them being enacted."

Influence over the judiciary and how laws are interpreted could also be important, as Gezelius adds: "Investors with a long-term horizon should be focused not only on the candidates' economic policies, but also consider the President's power to nominate Supreme Court justices since breaking the current deadlock is likely to have profound consequences for the US society over many years."

While the impact of an election result on companies can be unpredictable, it is not something we can ignore and we will continue to monitor our portfolios closely throughout the US election political process. We are confident that our selection of high quality companies, which are capable of generating sustainable earnings over different economic and political cycles, is ultimately the best way of maximising long-term value for our portfolios and clients.

NB: All SKAGEN fund information as at 30 September 2016 unless stated

NBB: All holding company information as at 30 June 2016 unless stated