Le contenu de cette page relève de la communication marketing

SKAGEN Performance Update – A Tumultuous First Quarter

The 11-year-long bull market in global equities ended abruptly in the first quarter as the coronavirus triggered an unprecedented shutdown of business activity around the globe. Volatility rocked the markets and our funds were also affected.

SKAGEN Global

US holdings drive relative gains as coronavirus pandemic breaks 11-year global equity bull run

SKAGEN Global A was down 15.51% over the quarter, outperforming the MSCI All Country World Index which dropped 19.25%.

Figures as at 31/03/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 07/08/1997

** Before 01/01/2010 benchmark was MSCI World Index

SKAGEN Global is a high conviction, active equity fund which aims to generate long-term capital growth by investing in undervalued companies from across the globe.

Quarterly Report: Read the SKAGEN Global Q1 2020 report for more informationVideo Update: Watch a coronavirus update by Portfolio Manager, Knut Gezelius

SKAGEN Kon-Tiki

Absolute and relative weakness as Materials holdings struggle amid global economic shutdown

SKAGEN Kon-Tiki A fell 25.77% during the quarter, underperforming the MSCI Emerging Markets Index which dropped 21.84%.

Figures as at 31/03/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 05/04/2002

** MSCI EM Index (net total return) did not exist at the inception of the fund and consequently the benchmark index prior to 1/1/2004 was the MSCI World AC Index. This is not reflected in the table above which shows the MSCI EM Index since the fund’s inception

SKAGEN Kon-Tiki is a highly active, global emerging market equity fund which seeks to generate long-term capital growth through a high conviction portfolio of companies which are listed in, or have significant exposure to, developing markets.

Quarterly Report: Read the SKAGEN Kon-Tiki Q1 2020 report for more informationVideo Update: Watch a coronavirus update by Portfolio Manager, Fredrik Bjelland

SKAGEN m²

Global real estate hit by coronavirus shutdown and market volatility; long-term drivers intact

SKAGEN m² A dropped 25.19% during the quarter, underperforming the MSCI All Country World Index Real Estate IMI benchmark index which was down 24.54%.

Figures as at 31/03/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 31/10/2012

** Benchmark was the MSCI ACWI Real Estate IMI ex REITS from 11/07/2017 to 30/09/2019

SKAGEN m² is a long-only, actively managed real estate fund that seeks to generate long-term capital growth by investing in listed property companies from across the globe.

Quarterly Report: Read the SKAGEN m² Q1 2020 report for more informationSKAGEN Focus

Absolute and relative losses; portfolio attractively valued and positioned for Asia recovery

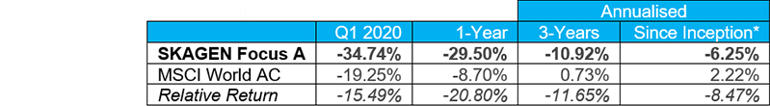

SKAGEN Focus A dropped 34.74% over the quarter, underperforming the MSCI All Country World Index which fell 19.25%.

Figures as at 31/03/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 26/05/2015

SKAGEN Focus is a high conviction, active equity fund that seeks to generate long-term capital growth by investing in a portfolio focused on small and mid-cap companies from across the globe.

Quarterly Report: Read the SKAGEN Focus Q1 2020 report for more information