Le contenu de cette page relève de la communication marketing

A solid quarter for the funds

Despite the market turbulence, good stock selection meant that our funds performed well in the second quarter.

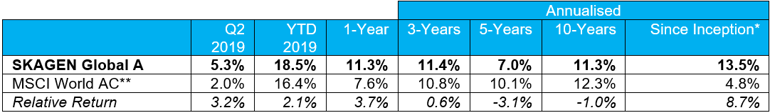

SKAGEN Global

US holdings’ strength drives absolute and relative gains as four new holdings enter the fund.

Our global equity fund SKAGEN Global A climbed 5.3% over the quarter, outperforming the MSCI All Country World Index which rose 2.0%.

Figures as at 30/06/2019 in EUR, net of fees and annualised for periods greater than 1 year.

* Inception date: 07/08/1997

** Before 01/01/2010 benchmark was MSCI World Index

Quarterly Report: Read the SKAGEN Global Q2 2019 Report.

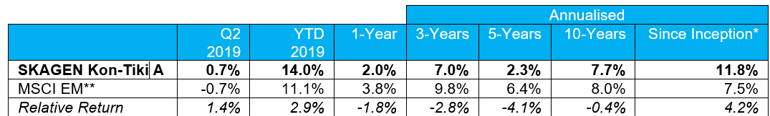

SKAGEN Kon-Tiki

New investments contribute positively as monetary policy turns dovish amid EM volatility.

Our emerging markets equity fund SKAGEN Kon-Tiki A added 0.7% in the quarter, outperforming the MSCI Emerging Markets Index which fell 0.7%.

Figures as at 30/06/2019 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 05/04/2002

** MSCI EM Index (net total return) did not exist at the inception of the fund and consequently the benchmark index prior to 1/1/2004 was the MSCI World AC Index. This is not reflected in the table above which shows the MSCI EM Index since the fund’s inception.

Quarterly Report: Read the SKAGEN Kon-Tiki Q2 2019 Report.

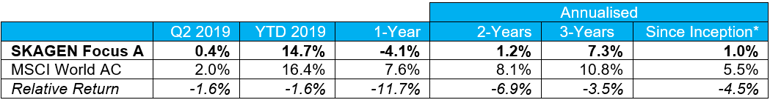

SKAGEN Focus

Metro takeover offer drives absolute gains as global trade tensions create new opportunities.

Our high concentration global equity fund SKAGEN Focus A increased 0.4% over the quarter, underperforming the MSCI All Country World Index which added 2.0%.

Figures as at 30/06/2019 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 26/05/2015

Quarterly Report: Read the SKAGEN Focus Q2 2019 Report

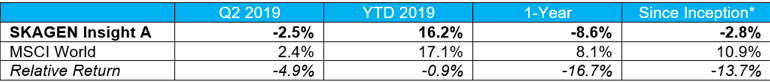

SKAGEN Insight

Activism headwinds as trade war sparks market jitters but portfolio progress remains positive.

Our shadow activist equity fund SKAGEN Insight A lost 2.5% during the quarter, underperforming the MSCI World Index which rose 2.4%.

Figures as at 30/06/2019 in EUR, net of fees and annualised for periods greater than one year.

*Inception date: 21/08/2017

Quarterly Report: Read the SKAGEN Insight Q2 2019 Report.

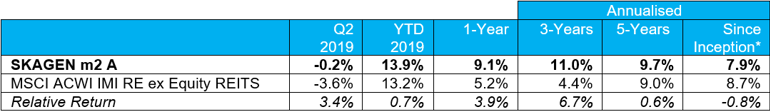

SKAGEN m2

Scandinavian holdings drive relative gains; portfolio resilient and attractively valued.

Our global real estate equity fund SKAGEN m2 A dipped 0.2% during the quarter, outperforming the MSCI All Country World Index IMI Real Estate ex Equity REITS index which fell 3.6%.

Figures as at 30/06/2019 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 31/10/2012

Quarterly Report: Read the SKAGEN m2 Q2 2019 Report.

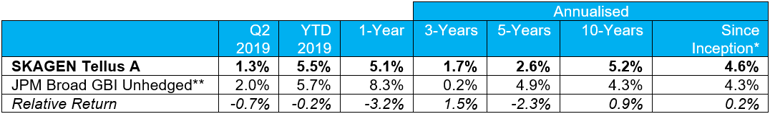

SKAGEN Tellus

Falling long-term interest rates and tightening credit spreads drive positive absolute return.

Our global bond fund SKAGEN Tellus A added 1.3% in the quarter, underperforming the JPM Broad GBI Unhedged index which climbed 2.0%.

Figures as at 30/06/2019 in EUR, net of fees and annualised for periods greater than one year

* Inception date 29/09/2006

** Before 01/01/2013 benchmark was Barclay's Capital Global Treasury Index 3-5 years

Quarterly Report: Read the SKAGEN Tellus Q2 2019 Report.

----------

All contribution figures are based on NOK returns at the fund level.